|

View this email in a browser

In this Update:

- Telephone Town Hall

- Senate Republicans Announce Priorities and Principles for 2023-24 Session

- Senators Unveil Bills to Promote Economic Growth, Attract New Employers

- Committee Votes to Eliminate Costs for Genetic Testing and Breast Cancer Screenings

- Senate Votes to Restrict Diversion of Transportation Funding

- Senate Urges President Biden to Restart Keystone XL Pipeline

- Homeowner Septic Program Helps Cover Cost of Septic Systems, Sewer Hook-ups

- “Honoring Our Women Veterans” Registration Plates

- Out and About in the 30th

Telephone Town Hall

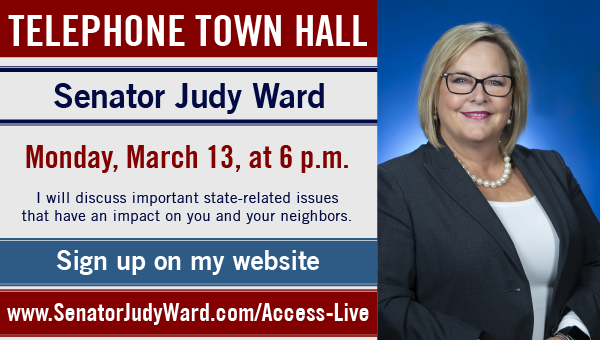

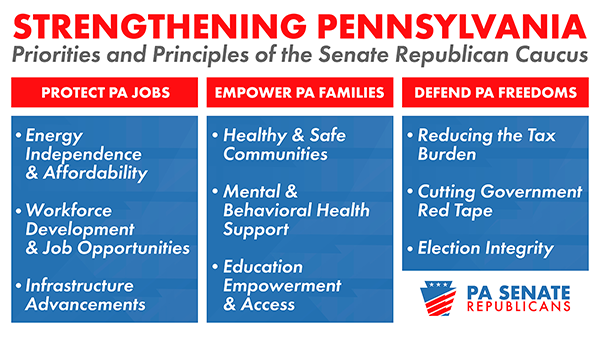

Senate Republicans Announce Priorities and Principles for 2023-24 Session

With the two-year legislative session getting into full swing, my colleagues announced the Senate Republican priorities and principles for 2023-24.

Our legislative efforts will be focused on protecting jobs, empowering families and defending freedoms.

Protecting Pennsylvania jobs requires a comprehensive approach that includes ensuring energy independence, promoting workforce development and continued improvement of our infrastructure.

Empowering Pennsylvania families means providing healthy and safe communities, addressing mental and behavioral health needs, and guaranteeing access to high-quality educational opportunities.

Defending freedom means keeping government out of the lives and pockets of citizens as much as possible, and instilling confidence in the electoral process.

Senate Republicans will build on our successful efforts last session that were focused on:

- Improving the state tax structure

- Redesigning higher ed

- Modernizing workforce development

- Creating new tax credits to generate jobs

- Improving broadband, water and transportation infrastructure

- And more

Senate Republican leaders discussed our 2023-24 priorities and principles here.

Senators Unveil Bills to Promote Economic Growth, Attract New Employers

To make Pennsylvania more economically competitive and ensure it is an attractive place to live and work, Sens. Ryan Aument (R-36), Tracy Pennycuick (R-24), Greg Rothman (R-34) and myself have unveiled a pro-growth tax reform package of bills.

The package of bills will:

- Accelerate the Corporate Net Income (CNI) tax reduction so it is more in line with a bill Aument sponsored in 2022,

- Increase the Net Operating Loss (NOL) carryover limitation, and

- Allow small employers to use the NOL deduction.

Sponsored by Aument and Rothman, Senate Bill 345 quickens the reduction of the commonwealth’s CNI tax by immediately dropping it to 7.99% and then reducing it an additional 1% every January until it falls to 4.99%.

As part of the 2022-23 state budget, Pennsylvania’s CNI tax rate began the transition from 9.99% to 4.99% over the course of nine years.

“A more competitive business tax code offers far more benefits than simply improving the state’s business climate. Studies have shown that decreasing the CNI leads to better job opportunities, higher workers’ wages, and improved communities – all of which create family-sustaining jobs and attract and retain new talent,” the senators said.

To bring family-sustaining jobs to the commonwealth and grow existing Pennsylvania businesses, the second bill will gradually increase the NOL carryover limit from the current 40% to 80% over four years. Senate Bill 346, sponsored by Sens. Aument, Pennycuick and Rothman, will bring the NOL carryover limit in line with both the federal limitation and the limitations of 48 other states.

“The current restriction hurts Pennsylvania job creators and turns away businesses that might otherwise choose to locate in our state. For Pennsylvania to compete nationally and attract new businesses, we must address this anti-growth policy,” the senators said.

Senate Bill 347, sponsored by myself, will help the commonwealth’s small businesses by allowing them to use the NOL deduction. This accounting tool, which gives small businesses greater control over their financial positions, is already available to large corporations – creating a disparity between the two.

“Small businesses are the backbone of our economy, and we need to give them the same tools and advantages that we give larger corporations. Allowing these mom-and-pop shops to use a net operating loss provision will help them to grow and succeed,” the senators said.

All three bills will be referred to the Senate Finance Committee for consideration.

Committee Votes to Eliminate Costs for Genetic Testing and Breast Cancer Screenings

Legislation I’m co-sponsoring to eliminate all out-of-pocket costs for genetic testing of hereditary cancer syndromes and supplemental breast screenings for women with a high lifetime-risk of developing breast cancer took a step toward Senate passage this week.

Senate Bill 8, a bipartisan, first-of-its-kind, comprehensive breast cancer screening and testing bill was approved by the Senate Banking and Insurance Committee and is poised for consideration by the full Senate.

Genetic testing often leads to early cancer detection or preventive treatments and procedures. It not only informs the tested individual, but also provides vital information to family members who may have a high likelihood of inheriting a gene mutation.

Senate Bill 8 expands on a 2020 law that secured insurance coverage for breast MRIs by removing any applicable patient copays, deductible and coinsurance for this preventive screening. A supplemental screening is necessary because of failed early detection by screening mammography among women with dense breasts and those at high lifetime risk of breast cancer.

Senate Votes to Restrict Diversion of Transportation Funding

To bolster funding for Pennsylvania’s transportation infrastructure, the Senate passed legislation to restrict the diversion of transportation funding out of the Motor License Fund. The bill now heads to the House of Representatives for consideration.

The Motor License Fund obtains revenue from transportation charges, including the gas tax, vehicle registration fees and driver license fees. These funds are required by the Pennsylvania Constitution for the design, construction and maintenance of the state and local highway network. However, a large portion is transferred to the Pennsylvania State Police for statewide highway patrol operations.

Senate Bill 121 dedicates the transportation charges to road and bridge safety projects, while ensuring the Pennsylvania State Police receive reliable, sustainable funding from sources beyond the susceptible Motor License Fund. The bill caps transfers from the Motor License Fund at $250 million in 2023-24 then reduces the transfer by $50 million annually. The bill seeks to end the transfers by 2028-29 and allocate all transportation fees for road and bridge improvements.

Senate Urges President Biden to Restart Keystone XL Pipeline

The PA Senate passed a resolution calling on President Biden to allow completion of the Keystone XL pipeline to create nearly 60,000 jobs and strengthen our energy independence in uncertain times.

Senate Resolution 9 urges the president to restart and expedite the completion of the Keystone XL pipeline, which had its permit canceled through an executive order on his first day in office.

A report from the U.S. Department of Energy showcased that the construction of the pipeline would have generated between 16,149-59,468 jobs annually and contributed $3.4 billion to the United States Gross Domestic Product. Incredibly, while President Biden blocked American jobs, he waived sanctions on the Russian firm responsible for the Nord Stream 2 pipeline between Russia and Germany.

The resolution will now be transmitted to President Biden and members of Congress, including the entire Pennsylvania Congressional delegation.

Homeowner Septic Program Helps Cover Cost of Septic Systems, Sewer Hook-ups

Functioning on-lot septic systems, laterals and connections to a public sewer system are essential for public health but are expensive to repair or replace.

The Homeowner Septic Program offers affordable loans for the repair or replacement of on-lot septic systems and sewer laterals, or a first-time sewer connection from an existing home. The revamped program now features:

- No restrictions on household income

- A streamlined application process

- Loan amounts up to $25,000 for all homes (including manufactured homes)

- No prepayment penalty

The program is funded and administered by Pennsylvania Infrastructure Investment Authority (PENNVEST) and the Pennsylvania Housing Finance Agency (PHFA).

For more information or to start the PENNVEST application process, homeowners should contact a participating lender or PHFA at 1-855-U-Are-Home (827-3466), then press “0” to be connected with the Customer Solutions Center. Information on the program is also available here. Lenders interested in participating should visit the PHFA website for more details.

“Honoring Our Women Veterans” Registration Plates

As the nation celebrates Women’s History Month in March, the Department of Military and Veterans Affairs (DMVA) reminds drivers that purchasing an Honoring Our Women Veterans License Plate both recognizes the importance of women who served and supports programs assisting women veterans in Pennsylvania.

Each plate costs $37, with $15 going directly to the Pennsylvania Veterans’ Trust Fund (VTF). The VTF regularly issues grants to statewide charitable organizations assisting veterans service organizations and county directors of veterans affairs. The grants are used to aid veterans in need of shelter, essential goods and other services.

“Pennsylvania’s nearly 64,000 women veterans have made significant contributions to our military, nation, and communities. It is with great pride that we recognize their commitment to our country with a special license plate created in their honor,” said Maj. Gen. Mark Schindler, Pennsylvania’s acting adjutant general and head of the DMVA. “Purchasing one of these special plates not only pays tribute to women veterans and their contributions, but a portion of the proceeds helps to fund the Veterans’ Trust Fund grants that support all veterans across the commonwealth.”

“PennDOT is proud to recognize the accomplishments of women veterans by offering this special license plate created in their honor,” said Mike Carroll, acting PennDOT secretary. “With this plate attached to cars traveling throughout the Commonwealth, Pennsylvanians everywhere are reminded that we owe a debt of gratitude for the sacrifices of women veterans who served to preserve our freedom.”

The Honoring Our Women Veterans license plate is available for passenger cars or trucks with a registered gross weight of not more than 14,000 pounds.

Additionally, Honoring Our Veterans license plates for passenger cars, trucks with a registered gross weight of not more than 14,000 pounds, and motorcycles are available for $38 each, with $15 from each plate also going to the VTF.

Out and About in the 30th

I had the honor of presenting a citation to Randy Feathers, who was the recipient of the 2023 “Respected Citizen” Award by the Central Blair Recreation and Park Commission. Randy has decades of service to his community, and I admire his dedication to serving others.

I hosted an open house last week for my new district office in Lewistown. My staff and I had a great time meeting so many people from the community, and I am excited to see how this new office can best serve you. For more information on this and all of my district offices, please check out my website at https://senatorjudyward.com/.

If you are not already subscribed to this newsletter please sign up here.

|