|

View this email in a browser

In this Update:

- Mifflin County Office Grand Opening

- Scam Warning: ‘Final Demand for Payment’ Targeting Pennsylvanians

- New Law Targets Growing Number of Fentanyl Overdose Deaths

- Help Available to Boost Security at Nonprofits and Religious Institutions

- Extra SNAP Payments Set to End

- Veteran Discounts are Available All Year

- 2023 Adult Trout Stocking Schedule Available

- Out and About in the 30th

Mifflin County Office Grand Opening

Scam Warning: ‘Final Demand for Payment’ Targeting Pennsylvanians

With the tax filing season underway, the Department of Revenue is encouraging Pennsylvanians to be on the lookout for scams that are designed to trick people into turning over sensitive data and personal information.

One recurring scam that has been reported to the department involves phony letters that are sent to taxpayers through the mail. The “Final Demand for Payment” letters threaten wage garnishment and the seizure of property or assets unless the recipient calls a phone number to satisfy a lien.

Understanding the Scam

The scam notices are sent through the mail from phony entities that closely resemble the name of a collection agency or a state taxing agency. Keep an eye out for dubious claims or suspicious details, such as:

- The phony letters come from “Tax Assessment Procedures Domestic Judgment Registry.” No such entity exists.

- The letters do not include a return address. A notice from the Department of Revenue will always include an official Department of Revenue address as the return address.

- The recipient owes the “State of Pennsylvania” unpaid taxes, rather than the Commonwealth of Pennsylvania or Department of Revenue.

- The phony letters are very generic and do not include any specific information about the taxpayer’s account. Legitimate letters from the Department of Revenue will include specifics, such as an account number and any liability owed, to give the taxpayer as much information as possible. Letters from the Department of Revenue also include more detailed contact information and multiple options to make contact with the department.

- The phony letters focus on public records, such as tax liens, that anyone can access. Enforcement letters from the Department of Revenue include more detailed information about the taxpayer’s account and any liabilities that are owed.

Tips to Avoid This Scam

The Department of Revenue is encouraging Pennsylvanians to keep the following tips in mind to safeguard against these types of scams:

- Look Closely for Imposters: Scam artists will pose as a government entity or an official business. If you are contacted through the mail, phone or email, do not provide personal information or money until you are absolutely sure you are speaking to a legitimate representative.

- Examine the Notice: Scam notices often use vague language to cast a wide net to lure in as many victims as possible. Examine the notice for identifying information that can be verified. Look for blatant factual errors and other inconsistencies. If the notice is unexpected and demands immediate action, take a moment, and verify its legitimacy.

- Conduct Research Online: Use the information in a potentially fraudulent notice, such as a name, address or telephone number, to conduct a search online. You may find information that will confirm the notice is a scam.

Steps to Follow if You are Concerned About a Notice

If you are concerned about a potentially fraudulent notice, visit the department’s Verifying contact by the Department of Revenue webpage for verified contact information. This will help you ensure that you are speaking with a legitimate representative of the department.

Steps to Follow if You are a Victim of a Scam

The Department of Revenue’s Bureau of Fraud Detection & Analysis is dedicated to protecting and defending Pennsylvania taxpayers and their tax dollars against fraud. The bureau is a one-stop resource for all identity theft and tax fraud issues in the commonwealth. If you believe you are a victim of tax fraud or tax-related identity theft, contact the Bureau of Fraud Detection & Analysis by emailing Ra-rvpadorfraud@pa.gov or calling 717-772-9297. The bureau’s phone line is open from 9 a.m. to 4:45 p.m., Monday through Friday.

For more information on ways to protect yourself, visit Revenue’s Identity Theft Victim Assistance webpage. You can also find further information about protecting yourself online at PA.gov/Cybersecurity.

New Law Targets Growing Number of Fentanyl Overdose Deaths

Fentanyl-laced heroin and counterfeit pills are killing an increasing number of Pennsylvanians. Legislation enacted by the General Assembly is now in effect to prevent overdose deaths by legalizing fentanyl test strips for personal use.

Effective Jan. 1, Act 111 of 2022 amended the Controlled Substance, Drug, Device and Cosmetic Act of 1972 to no longer define fentanyl test strips (FTS) as drug paraphernalia in Pennsylvania, making them a legal, low-cost method to prevent drug overdoses.

The Pennsylvania departments of Drug and Alcohol Programs, Health, and Human Services, along with the Pennsylvania Commission on Crime and Delinquency, created a survey for substance use disorder stakeholders to gauge demand for FTS while work is underway to make them available across the commonwealth. The survey contains questions on currently available trainings and materials, preferred brands and current distribution methods.

Help Available to Boost Security at Nonprofits and Religious Institutions

Applications are being accepted for state Nonprofit Security Grants for nonprofit organizations and religious institutions.

Administered by the Pennsylvania Commission on Crime and Delinquency, the program provides grants to nonprofit organizations that principally serve individuals, groups or institutions that are included within a bias motivation category for single bias hate crime incidents as identified by the FBI’s Hate Crime Statistics publication.

Grant awards can range from $5,000 to $150,000 for a wide variety of eligible items, including:

• Safety and security planning and training.

• Purchase of safety and security equipment and technology.

• Upgrades to existing structures that enhance safety and security.

• Vulnerability and threat assessments.

The application period closes March 2.

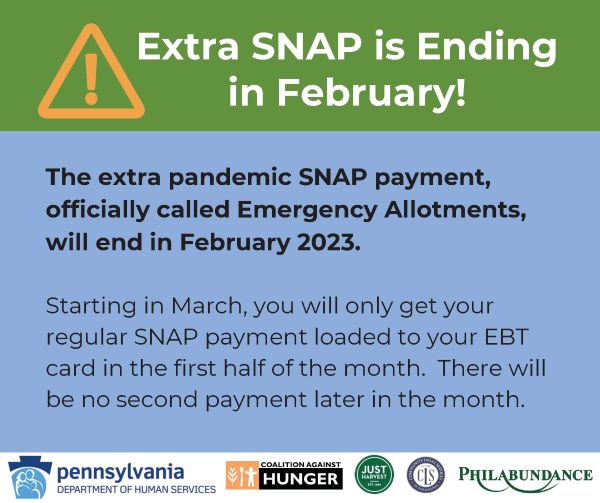

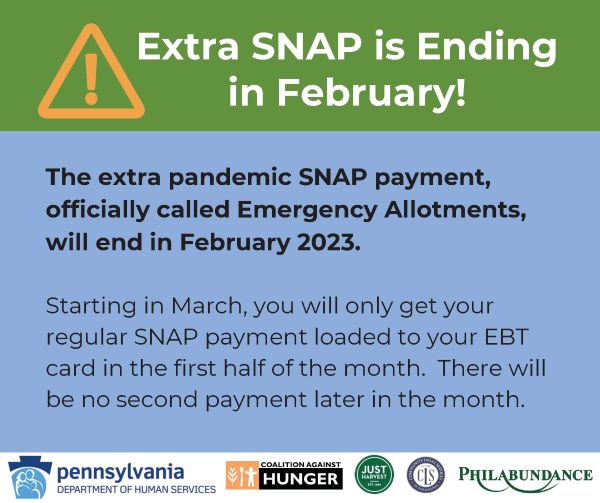

Extra SNAP Payments Set to End

During the COVID-19 emergency, the federal government allowed states to issue additional SNAP food assistance payments that increased the maximum available for households by at least $95 each month.

These extra payments will be ending after February and SNAP recipients will only receive one regular SNAP payment starting in March.

If you or someone you know needs help, there are food assistance programs available in your community. Visit the Department of Human Services or Department of Agriculture for information on food assistance programs and where to find local resources. Additionally, if recipients currently have extra funds on their cards, they will still be available. SNAP benefits only expire if cards are not used for nine months.

To ensure households are receiving the maximum SNAP benefit based on their individual circumstances, Pennsylvanians are encouraged to report changes to their household size, income or expenses online at dhs.pa.gov/COMPASS via the myCOMPASS PA mobile app or by calling 877-395-8930.

Veteran Discounts are Available All Year

Some businesses offer discounted prices for military service members and veterans on special days, but many others feature them all year.

A list of veteran discounts offered year-round by national businesses is maintained by the U.S. Department of Veterans Affairs. Check local businesses for their participation.

It’s a small way to show appreciation for the men and women who served our country, as well as the families they support.

2023 Adult Trout Stocking Schedule Available

The 2023 adult trout stocking schedule is now available. The Pennsylvania Fish and Boat Commission will stock approximately 3.2 million adult trout in 697 streams and 126 lakes open to public angling.

The trout stocking schedule is searchable by county, lists the waterways in alphabetical order, and indicates stocking dates, meeting locations for volunteers, and the species of trout that are planned to be stocked at each location. Pennsylvania’s statewide Opening Day of Trout Season is April 1. A single, statewide Mentored Youth Trout Day will take place March 25.

Trout to be stocked will include approximately 2.3 million Rainbow Trout, 707,000 Brown Trout and 168,000 Brook Trout. As with past practice, the average size of the trout produced for stocking is 11 inches in length with an average weight of .58 pounds.

Out and About in the 30th

Dr. Ron Darbeau, the new Chancellor of Penn State Altoona, spoke to the Blair Chamber Breakfast. He discussed his vision for PSU Altoona.

|