|

|||||

Senate Passes 2022-23 State Budget that Cuts Taxes, Funds Essential Services

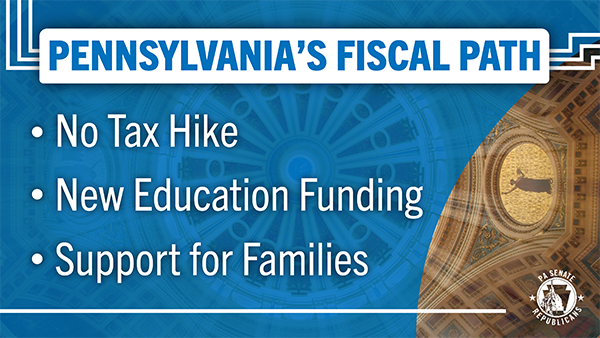

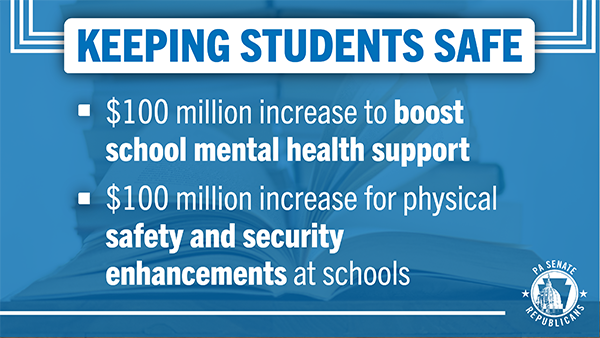

The Senate approved a $45.2 billion General Fund Budget for Fiscal Year 2022-23 that meets the needs of Pennsylvanians today without creating multi-billion-dollar budget deficits in the future. Senate Bill 1100 was sent to the governor for enactment. The $45.2 billion budget, which also includes federal American Rescue Plan Act (ARPA) funds, represents a 2.9% increase over the previous year’s spending – and $500 million less than Gov. Tom Wolf’s original budget request. Tax Cuts to Attract Employers and Residents The budget agreement does not include any broad-based tax increases and is structured in a way to minimize the risk of tax increases in the years ahead. In fact, the budget actually cuts the Corporate Net Income tax rate from 9.99% to 8.99% and creates a phased reduction to 4.99% by 2031, moves designed to attract employers and residents to Pennsylvania. Other changes also ensure out-of-state companies that do business in Pennsylvania pay the proper amount of taxes; modernize expense deductions for small businesses, allowing small business owners more flexibility and tax planning opportunities; and provide tax incentives for small businesses to grow and invest in Pennsylvania. Protecting Taxpayers in Future Years As important as the economic boost provided by this plan, which will have a projected ending balance of $3.6 billion, the 2022-23 budget includes a $2.1 billion transfer to the Rainy Day Fund, bringing the total balance to nearly $5 billion. These fiscally responsible steps are critical because many economic indicators are showing a risk of a recession on the horizon. Most recently, Pennsylvania’s Independent Fiscal Office estimated a 60% chance of economic stagnation or a “growth recession” happening, and a 30% chance of a recession. Supporting Education The budget includes a $525 million increase for Basic Education Funding, $225 million to provide additional support for the state’s 100 poorest school districts, a $100 million increase for Special Education funding, an additional $60 million for Pre-K Counts and $19 million more for Head Start Supplemental Assistance. It also includes an additional $125 million in Education Improvement Tax Credits to ensure more students can learn in the educational environment that best suits their needs. Higher education receives a funding boost as well. Increased funding is also dedicated in this year’s budget to ensure our schools are safe and secure: $100 million is appropriated for the Ready to Learn Block Grant program to address school-based mental health; and $100 million in funding is directed to a new General Fund appropriation for School Safety and Security to address physical safety and security at schools. Long-Term Care, Housing and Fuel Building on our efforts last year to help address the serious financial challenges of our nursing homes and long-term care providers, this budget includes $150 million for costs related to nursing home staffing, $250 million in ARPA funding for long-term living programs and $20 million for supplementary payments to personal care homes. Inflation is driving up the cost of everything, including housing, both owned and rented, and this budget directs $540 million in ARPA funding to help our most vulnerable and low-income residents by funding affordable housing construction programs, offering additional home repair assistance and bolstering the Low Income Home Energy Assistance Program and the Property Tax/Rent Rebate Program. Other Highlights of the New Budget

Out and About in the 30th

It was an amazing honor to be asked to read part of the Declaration of Independence at the Revolutionary Fort Roberdeau on Independence Day. |

|||||

|

|||||

Want to change how you receive these emails? 2026 © Senate of Pennsylvania | https://senatorjudyward.com | Privacy Policy |